How To Upload W2s To Mat

I of the near important taxation forms is the Westward-2. Unlike many revenue enhancement forms, virtually individuals taxpayers won't demand to fill this i out themselves. Rather, employers fill out W-ii forms for their employees. If you're an employer who doesn't know how to fill out a Due west-ii course, or you're not sure whether your employees need i, we've got the lowdown on everything you need to know.

A financial counselor tin assist y'all optimize your revenue enhancement strategy to help you achieve your financial goals. Detect a fiscal counselor today.

What Is a Westward-2 Grade?

There's a reason why a W-2 is referred to as a wage and taxation argument. Put merely, it's a form that shows how much coin an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS.

Not everyone needs a West-2 form. Independent contractors and folks who are self-employed need a 1099 form instead. But if your employees have made at to the lowest degree $600 in the tax year, you'll need to transport them a W-ii by the Jan 31st deadline. Fifty-fifty if someone makes less than $600, that person must receive a Westward-2 if any income, Medicare or Social Security taxes were withheld (taken out of their paychecks).

Take yous ever confused a W-2 form with a W-4? Information technology's a common mistake. But retrieve that employers complete W-2 forms and transport the completed forms to employees. Employees consummate W-4 forms. When someone starts a new chore or experiences a alter in their financial circumstances or revenue enhancement filing status, that person fills out a W-iv class to list deductions and tell employers the amount of taxes to withhold. Hither's how to fill up out your Due west-4.

How Many W-2 Forms Exercise I Need?

In total, employers produce half-dozen copies of every W-2 form. Iii of those copies go to the employee, who files them with their tax returns. Employers keep ane (Copy D) and send the other two to the authorities.

Let'due south suspension this down even further. Copy A goes to the Social Security Administration (SSA) along with a Westward-3 form that includes a summary of all of the West-2s for every worker on payroll. The SSA only accepts e-filed forms, non photocopies.

Copy i of the Westward-ii class goes to the appropriate land, city or local tax department. Employees keep Copy C for themselves. They file copies B and 2 with their federal taxation returns and state, city or local income revenue enhancement returns, respectively.

What Goes on a W-two Form?

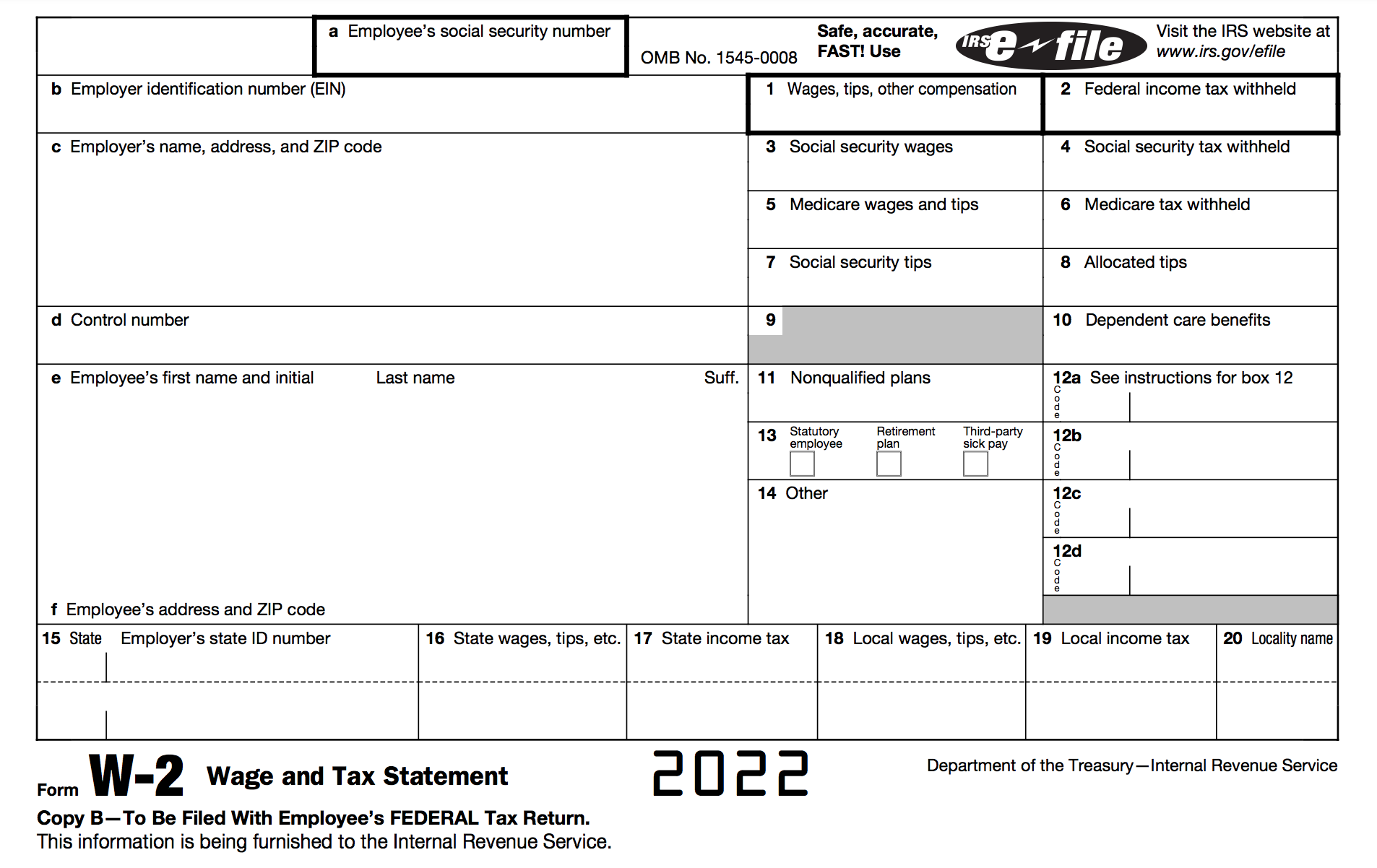

If you're an employer who isn't articulate on how to complete a W-2 form, consider this your official guide. An employee's social security number goes at the very summit. Directly beneath that is a spot for your identification number followed by your proper name and address.

Then in that location's the command number that yous may or may not use for payroll purposes. That comes right earlier the employee'southward name and mailing accost.

Boxes 1 – ten

Turning your attention to the numbers on the correct side of the form, you'll place an employee's annual earnings from wages and tips in box 1. Any taxes that have been withheld are included in that number, only deductions from things like IRAs aren't. Boxes two, 4 and vi are for the federal income taxes, Social Security taxes and Medicare taxes that you've paid Uncle Sam over the course of that tax year.

Do y'all work in the food and beverage industry? The amount in tips that your employee reports to you gets placed in box 7, but the actual corporeality they receive goes in box eight. Box 9 has been blank since 2011 when the authorities did away with the pay-as-you-go pick for the Earned Income Tax Credit. Now, eligible filers get their EITC in one big refund rather than over the course of the yr.

Box 3 is where you lot indicate the amount of income that'due south taxed for Social Security. Don't include any tips hither. Because this number reflects taxable earnings before deductions were made, information technology could be more than the amount in box 1.

The number in box 3 could also be lower than whatever appears in box i. That's because Social Security can't tax employees to a higher place a certain threshold, which is $142,800 for the 2021 tax year. In that location'south no cap on taxable earnings for Medicare, then the amount that's put in box 5 takes wages and tips into business relationship.

If your employees receive whatsoever deductions for childcare expenses, that amount goes in box 10.

Boxes eleven – 14

If your employee withdraws anything from a 457(b) plan or a non-qualified retirement plan, that dollar amount gets placed in box eleven. Box 12 might take fourth dimension to make full out because you lot'll need to enter different codes and amounts here depending on the benefits and boosted payments a worker receives. 20-6 codes ranging from A to Z and AA to EE are located on the back of the form for your convenience.

Box 13 has its own three boxes that you'll check to indicate that your employee is function of your retirement plan, received sick pay from a third party and is a statutory worker. Contained contractors count as statutory employees in certain situations, including when a full-time salesperson mainly works for one company.

Any other deductions that have been left out can be written in box xiv. Examples include tuition assistance and matrimony dues.

Boxes fifteen – xx

Write your state and employer state ID number in box 15 if your state requires you to do and so. Box xvi is for an employee'due south full earnings that are subject to country income tax withholding, while box 17 indicates the state income tax corporeality that's been withheld. All of the income eligible for local taxation must be placed in Box eighteen.

The amount of local taxes that have been withheld goes in box nineteen. Finally, box 20 is for the specific proper noun of the identify that the local taxes are tied to.

Employees: How to Find Your West-two Online and What to Do If It'due south Missing

Employers typically send out W-2 forms through the mail. Information technology's likewise mutual for your employer to brand your W-2 available online. If yous go to your company'south online payment or HR organisation, there is usually a tab for your revenue enhancement forms, including your W-2. Every bit mentioned higher up, the constabulary requires employers to transport your Due west-2 by the stop of January. It may take up to a couple of days after that deadline for forms to appear online. You lot tin can get a re-create of your Due west-2 straight from the IRS.

If you're missing a W-ii course or if y'all lose the course, it'southward of import to contact your employer as presently as possible. If you don't receive the forms by Valentine'due south Twenty-four hour period, it'south a good thought to requite the IRS a telephone call.

You'll need your W-2 to complete your tax render, but if worst comes to worst, you could make full out Course 4852 instead. That class serves every bit a substitute wage and tax statement if y'all didn't receive or otherwise lost your W-2. You might too want to consider asking for an extension if yous cannot get all of your necessary forms by the end of Feb.

If you happen to receive your W-2 later on and the data on it differs from the estimates you fabricated on Course 4852, you can complete an boosted grade (1040X) so that your taxation return is accurate. This is known as filing an amended tax return.

Bottom Line

W-2 forms reveal how taxes impact employees' annual earnings. Plus, they let workers know whether they tin await a tax refund from paying more than taxes than was necessary.

If you're an employee and your W-2 includes whatever errors, y'all'll need to report that information to your boss every bit soon as possible. In some cases – similar when your name on the form doesn't match the name on your Social Security bill of fare – you may need a whole new course.

Assist With Your Taxes

- A financial advisor could help you create a tax strategy for your investments and overall estate. SmartAsset's free tool matches you with up to three financial advisors in your area, and you tin interview your advisor matches at no cost to decide which one is right for you. If y'all're set to find an advisor who can help you achieve your financial goals, get started now.

- You can do your taxes by hand, transferring info from your W-two and other forms onto your Course 1040 according to the instructions. Or y'all could pay for a tax prep program to make it a little easier. Bank check out our roundup of the best taxation software to see which service is best for you.

- If you don't know whether you lot're better off with the standard deduction versus itemized, you might want to read upwardly on it and do some math. You could find that you lot'd salvage a significant amount of money one style or another, so it'due south best to educate yourself before the revenue enhancement return borderline.

Photograph credit: ©iStock.com/ITkach, Image of 2018 W-2 Class comes from IRS.gov, ©iStock.com/Steve Debenport

How To Upload W2s To Mat,

Source: https://smartasset.com/taxes/how-to-fill-out-your-w-2-form

Posted by: piketheirey.blogspot.com

0 Response to "How To Upload W2s To Mat"

Post a Comment